e|cash Wallet

Today we are carrying out a soft launch of our fintech initiative as well as a game changing piece of financial technology.

Background

Nigeria’s economy is predominantly cash based. It is cultural in some ways really. Indeed 80% of total cash in the Nigerian economy is outside the banking system.

Also noteworthy is that 90% of all bank deposits are owned by 2% of Nigerians. Only 10% of deposits are owned by the remaining 98% of the banked Nigerians. 72 million Nigerians do NOT own bank accounts.

The reason for this is given in this late 2016 survey

Of the people that do own bank accounts and ATM / Debit cards, most typically use it for one thing — cash withdrawals at banks ATMs leading to mostly long queues with its attendant frustrations.

Against this backdrop, the question then becomes how one goes about solving this multifaceted Gordian knot especially with respect to CBN’s cashless drive of financial inclusion and inclusive economic growth.

Enter the BLOCKCHAIN

One clear fact though is the deepening penetration and widespread smart phone use in Nigeria. Indeed as at June 2016, statistics show there are well over 92 million mobile Internet users in Nigeria.

On the back of this and in an attempt to solve this conundrum, Digital Encode sought to build a mobile peer-to-peer payments system devoid of any financial intermediary leveraging the blockchain technology.

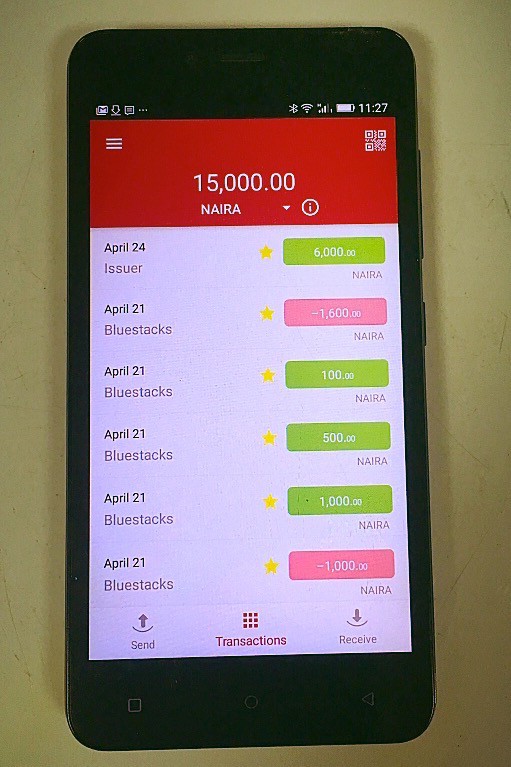

The final product is what we call the e|cash Wallet

e|cash Wallet: How it works

Only an android device and Internet access are needed to access this revolutionary mode of financial system.

A user has to just download the free e|cash Wallet app from the Google playstore and create a wallet by following the instructions. This process takes less than 2 minutes. You will be given an Address (as this is a wallet, there’s no concept of an account). This address serves as your public key and functions much like a regular bank account number (only it’s not a number) where digital cash will be sent to and from.

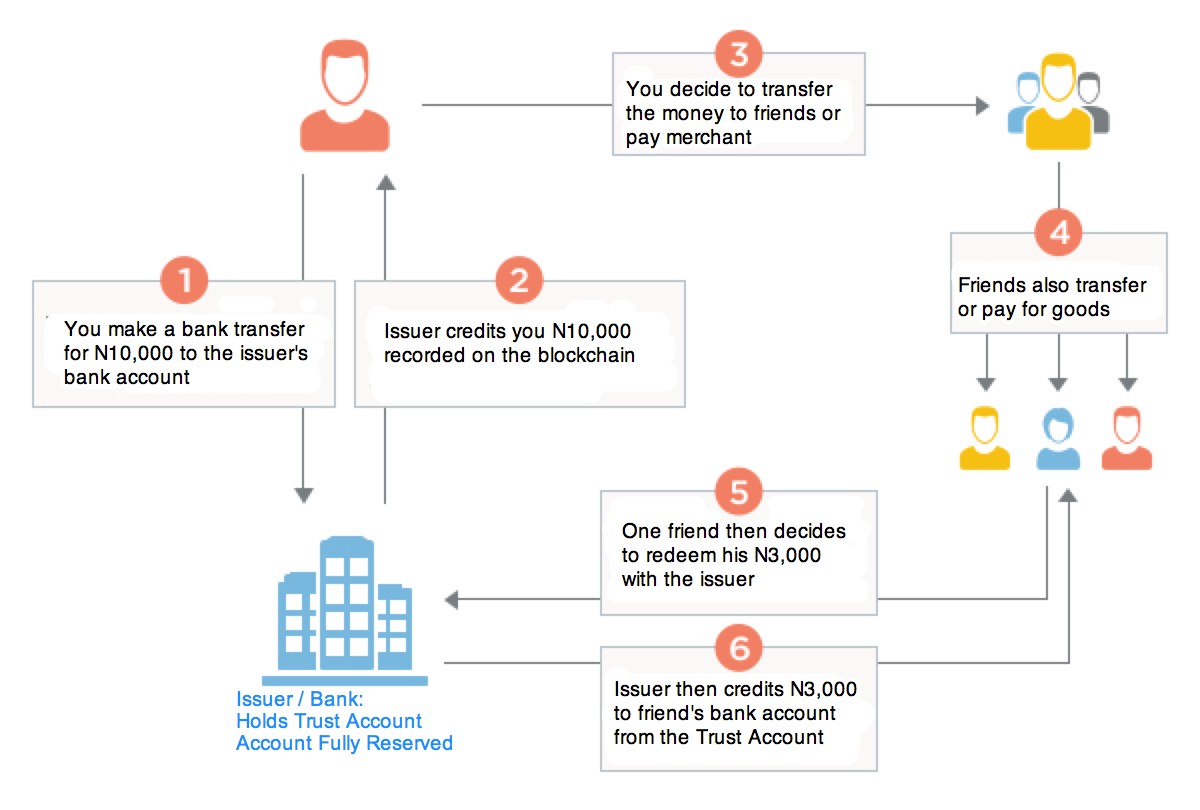

To get digital cash into your mobile wallet, you need to send some funds by logging on to your Internet banking or walking into a branch of your bank (if you are unbanked) to make a regular bank deposit into a trust account held by the bank for say N10,000. You will be credited with N10,000 digital cash on your e|cash mobile wallet.

This transaction is automatically recorded on the blockchain. You can then send this digital cash to your friends (either in return for something or as a gift), or pay a merchant for goods or services. The digital cash continues to be tracked on the distributed ledger system.

Eventually one friend will want to convert this digital cash for real (physical) cash. She would then need to go back to the bank, give them her bank account number, and send them the digital cash that she got from you. They would then transfer her the physical cash equivalent from the trust account directly into her bank account or be given cash (if unbanked). Remember the trust account is fully reserved. N1 of digital cash is always equivalent to N1 of physical cash held in reserve.

Schematic: How It Works

Blockchain & Tokenization: Digital Cash (Asset Backed tokens) wonderful in being easy to transfer, with good record-keeping. Issuer has to be fully liquid and trust account has to be fully reserved one-to-one

There are quite a few distinctions about this:

Firstly, this is like holding physical cash in your physical wallet. It works like a digital bearer instrument. Secondly, the transactions all settle immediately — practically unheard of in traditional payment systems where there is a 3rd party involved. All you need to conduct financial transaction is the Internet and it’s PUSH payment — meaning no one has access to your cash but you. Not even the bank or issuer. It is also available 24/7 all year round with no downtime or loss of service.

Another interesting side note: the money is stored and executed purely on the blockchain and held in your wallet. Transaction fees on the blockchain typically cost N10 per transaction (regardless of value)— at par with the cheapest product you can buy (pure water). The lowest transaction charges ever. It also means you can carry out micro-transactions of less than N100.

It subsequently solves the problem of counterfeiting. Furthermore, the velocity of money can be fully tracked on the blockchain.

Digital cash can be used for in-store (proximity) payments via QR code scanning, instant settlement of domestic remittances to family and friends and remote payments to sellers that do not have an online presence. It can later be redeemed by any user for physical cash. However, regular transactions charges apply when redeeming digital cash, that is, when moving off the blockchain rail.

Ultimately, we expect that users won’t trade back into cash or redeem. Like other financial technology, this will take some getting used to.

How secure is it?

e|cash Wallet is actually a more secure proposition than cash.

This is the most secure payment system out there because it leverages the distributed ledger technology for transactions. It is distributed (no central point of failure) and decentralised (no central point of control) and it has 100% uptime.

In addition, unlike traditional payments system, it uses public and private keys and every transaction is signed locally and transmitted to a blockchain node without revealing your wallet seed or private keys.

During registration, the most important information is the wallet seed (private key). It is a set of 15 words and constitutes your private key. You will need to save it somewhere safe or keep it in a vault just as you will never need it unless you misplace your phone. With the seed you can always recover your account by importing the seed. The seed will get stored on your phone only and AES encrypted with a password provided by you. The seed is temporarily unlocked when you want to sign and send a transaction. All this is done automatically for you.

Remember the seed should NEVER be given to anyone. Not even your bank or the issuer.

Further, we employed PIN protection to eliminate the need of entering a long password on your mobile device. The random key, by which the password AES encrypted, is stored on the device and can be retrieved only using your pin. There are only 4 attempts of incorrect pin entry. Otherwise, it will no longer used and full password will be required to unlock the funds.

New Dawn in Fintech

Say goodbye to ATM cards, cheques, long queues at the cash machine, failed online transactions, poor POS connectivity, high transaction fees and electronic fraud.

All you need to do is #e|cash

Welcome to a new dawn in digital finance. Welcome to money movement on the blockchain. Welcome to the dawn of Digital Cash.

We think this will assist in CBN’s drive for financial inclusion.

Because we are technology providers, we are open to collaboration with deposit taking financial institutions.

About e|cash

e|cash is a wholly owned dependent subsidiary of Digital Encode Ltd and is pioneering the use of blockchain technology in finance and other key areas of the economy. More details about the e|cash wallet blockchain can be found here and here.

e|cash is a wholly owned dependent subsidiary of Digital Encode Ltd and is pioneering the use of blockchain technology in finance and other key areas of the economy. More details about the e|cash wallet blockchain can be found here and here.

You can download the Mobile wallet here. The detailed technical whitepaper is here

Leave a Reply